Experion stands committed to a future where compliance drives innovation, building resilient tech solutions that meet today’s needs and tomorrow’s aspirations. As Environmental, Social, and Governance (ESG) standards become more prominent, ESG compliance has quickly turned into a critical business requirement. For companies, ensuring adherence to ESG regulations isn’t just about meeting current expectations—it’s about future-proofing against emerging rules, building trust, and sustaining growth in a world increasingly focused on sustainable and ethical operations.

Why ESG Compliance is Essential

With regulators, investors, and consumers closely monitoring corporate ESG performance, companies face mounting pressure to align with environmental standards, social values, and governance principles. ESG compliance offers several core benefits:

Reducing Regulatory Risk

Complying with ESG regulations minimizes the risk of fines, penalties, or operational disruptions due to non-compliance. Regulatory bodies across the globe are introducing ESG-specific legislation, such as emissions limits, reporting mandates, and supply chain transparency requirements.

Enhancing Brand Credibility

Companies known for their compliance with ESG regulations build stronger reputations and trust with consumers, investors, and partners. Transparent ESG practices underscore a company’s commitment to integrity, positioning it as a responsible player in the market.

Access to Investment and Financing

ESG compliance is increasingly influencing investment decisions, as financial institutions integrate ESG metrics into their evaluation processes. Companies with high ESG compliance ratings attract more investors and financing opportunities, ultimately supporting long-term financial stability.

Key Areas of ESG Compliance

To establish a solid compliance foundation, companies should focus on several critical ESG aspects, including:

Environmental Compliance

- Emissions Standards: Adhere to regulatory emissions limits and invest in emissions-reducing technologies.

- Waste Management: Implement waste reduction practices and promote circular economy principles.

- Resource Usage: Conserve resources like water and energy to meet sustainability standards and reduce operational costs.

Social Compliance

- Labor Laws and Fair Practices: Ensure fair wages, safe working conditions, and anti-discrimination policies that comply with labor standards.

- Supply Chain Transparency: Enforce compliance across the supply chain, respecting human rights and promoting fair labor practices.

- Community Engagement Regulations: Follow guidelines on community impact and corporate philanthropy to positively contribute to local areas.

Governance Compliance

- Data Privacy and Security: Follow data protection laws and adopt strict cybersecurity measures.

- Board and Executive Accountability: Establish transparent board structures and executive compensation policies.

- Anti-Corruption Policies: Implement strict policies against bribery and corruption to avoid legal issues and maintain ethical standards.

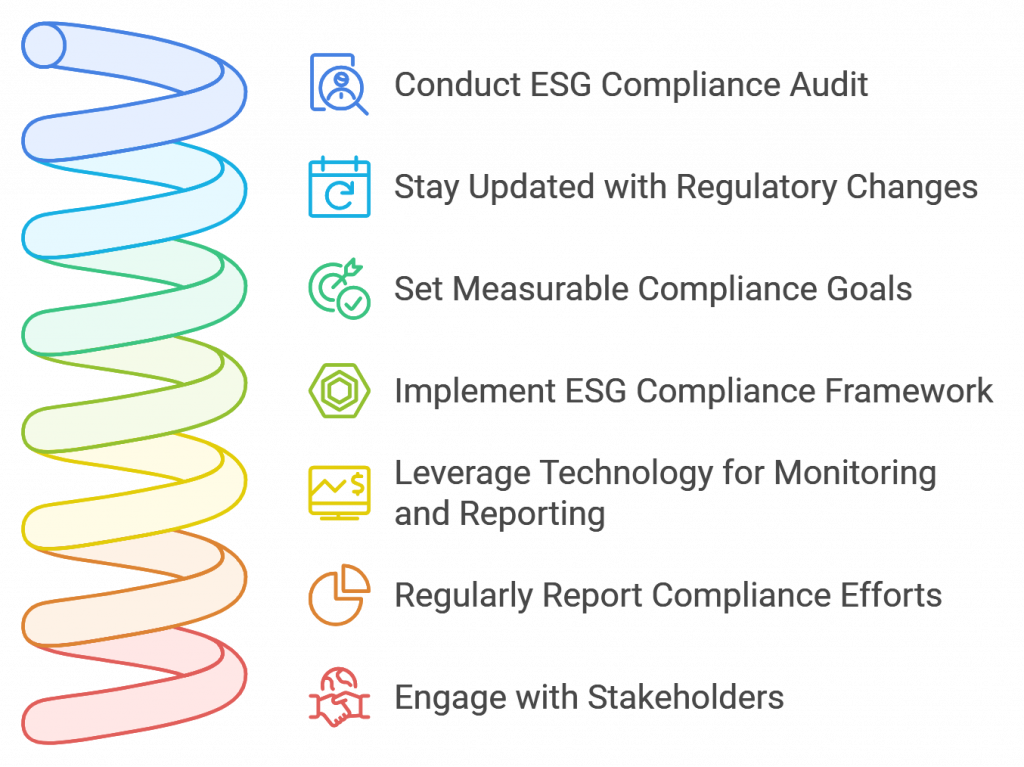

Steps to Achieve ESG Compliance

A comprehensive approach is essential to meet ESG compliance standards:

Conduct an ESG Compliance Audit

Start by assessing your current ESG practices and identifying areas that may not align with regulatory standards. This audit should cover all three pillars: environmental, social, and governance.

Stay Updated with Regulatory Changes

ESG regulations are rapidly evolving. Regularly monitor relevant laws and industry guidelines to ensure compliance, especially as different regions have varying ESG requirements.

Set Measurable Compliance Goals

Develop clear, actionable goals that are specific to each aspect of ESG compliance. These can include emissions targets, workplace diversity objectives, and anti-corruption policies.

Implement an ESG Compliance Framework

Create an internal framework with dedicated teams or individuals responsible for monitoring and enforcing compliance across departments. This ensures accountability and consistent tracking.

Leverage Technology for Monitoring and Reporting

Use digital tools and software to track ESG metrics, streamline data collection, and report progress. Automating the compliance process reduces errors and ensures accurate reporting for regulators and stakeholders.

Regularly Report Compliance Efforts

Transparent reporting builds trust and keeps stakeholders informed. Annual ESG reports, for example, showcase compliance efforts and help secure investor confidence.

Engage with Stakeholders

Communicate your ESG compliance commitments to investors, employees, and the public. Their support can reinforce your ESG efforts and foster a culture of accountability.

Conclusion

ESG compliance is more than a regulatory checkbox; it’s a commitment to responsible business practices that align with societal and environmental expectations. By adopting a robust compliance approach, companies can mitigate risk, build credibility, and position themselves as leaders in sustainable practices. As ESG regulations continue to evolve, staying proactive and adaptive will be key to maintaining compliance and fostering long-term growth.

At Experion, ESG compliance isn’t just a requirement—it’s the backbone of our commitment to creating sustainable, forward-thinking technology. We integrate ESG principles into every solution, ensuring that our clients not only meet global standards but also lead in driving responsible innovation. From enhancing operational transparency to implementing advanced compliance frameworks, we empower businesses to turn ESG goals into a launchpad for groundbreaking, resilient tech solutions that inspire trust and long-term growth.

With Experion’s guidance, ESG compliance transforms from a requirement into a powerful asset, paving the way for a future built on sustainable innovation. Connect with us now!c