Context

On April 8, 2024, the European Union`s Instant Payments Regulation came into force, making instant Euro payments fully accessible to consumers, businesses and investors throughout the EU and EEA countries.

Need for instant payments and the key beneficiaries

The key aim of instant payments is to ease the cash flow for all players especially retail clients, SMEs, NGOs and other smaller institutions by ensuring immediate credit at a cost that is not more than any other traditional payment mechanism. As a reference, in 2022, only 11% of the payments were executed within seconds. Nearly €200bn is locked in transit on any given day. Instant payments will unlock this lost value and ease cash flows delays in which typically stymie the smaller businesses. This will also pave way for EU in its attempt to reduce the extensive dependence on foreign financial operators like Visa and Mastercard to strengthen its own financial autonomy.

Salient features:

- Instant credit transfers processed 24×365 and within 10 seconds with receipt generation

- Instant conversion to Euros by PSPs if payment is submitted from a non-Euro account

- PSPs should have established robust fraud detection measures to prevent transfers to a wrong person

- PSPs to have extra measures to prevent criminal activities such as money laundering and terrorist financing

- Instant payments should cost no more than the traditional transactions in Euros

- The Instant Payments Regulation amends the Settlement Finality Directive to allow payment and e-money institutions (PIEMIs) access to payment systems, mandating instant credit transfer services after a transitional period. It also implements safeguards to mitigate any additional risks to the system.

How does this translate into a key technology and operational impact for PSPs?

Implementing instant payments will call for a full impact assessment across the lifecycle of a transaction. Broadly it will cover the channels from which the transactions are generated, payment routing technology (the scheme/rail against which the payment needs to be routed and in this case, the Instant payment connecting to RT1 system), pre-transaction checks including new rule bases, customer screening, beneficiary validation impacting either the master data modules or the payments hub technology in play at an institution. In addition, the accounting impact to reflect the value date to equate with transaction date may call for changes to ERP as well as core banking engines which would record the journal entries for each transaction.

Some specific and critical impact areas for institutions to bear in mind are:

- Instant credit will mean value date to remain the same as the transaction date irrespective of which calendar day it This means introduction of rules in payments technology to override holiday calendars that traditionally have been applicable to payment settlements

- Instant euro conversion will mean the payment engines in play at PSPs are geared to convert non-euro payments into euros instantaneously and the rule bases are established accordingly

- Payee verification / confirmation of payee becomes a mandatory feature to be implemented to prevent payments getting routed to the wrong person. Under the new regulations, instant payment providers must confirm that the beneficiary’s IBAN (International Bank Account Number) and name correspond to one another, enabling them to notify the payer of potential errors or fraud before the transaction is completed

- Daily verification of the entire customer base of an institution against all relevant and applicable sanctions list becomes mandatory for each and every PSP. Furthermore, if any of the sanctions list as applicable to a PSP is updated intra-day by the relevant regulatory body, the sanctions screening will also need to be run intra-day by each and every institution responsible for processing a payment

- There would be rule bases in payments technology to be implemented to ensure that instant payments are not levied with charges that exceed the traditional credit transfers

- There is a cap of €100,000 per transaction. This calls of introduction of a new rule base with a logic to identify a transaction that is pre-agreed to be executed instantaneously if it exceed this value.

- Since the Instant Payments Regulation will enable PSP, including all organizations licensed to offer payment services within the European Union, such as banks, payment services providers, and mobile payment providers, some of these players will need to embark on implementing the entire technology framework to execute instant payments.

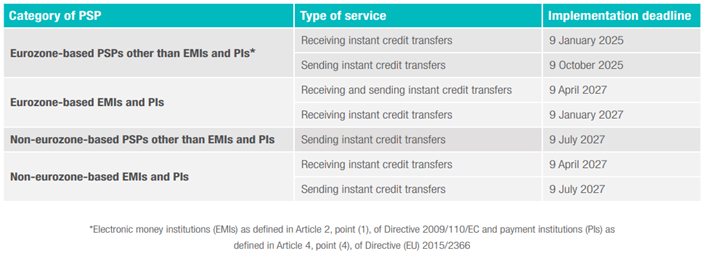

Implementation timelines as applicable to institutions. Failure to implement this would mean that institutions can be fined upto 10% of their turnover:

About Experion

Experion Technologies is a Global Product Engineering Services company offering enterprises future-ready and transformative digital solutions. The company is a partner to 500+ global customers across 36 countries, driving new revenue streams and digitalizing businesses for Fortune 100 and Fortune 500 companies in the Healthcare, Retail, Transport and Logistics, BFSI, Construction and Engineering, and EdTech sectors.