What is Financial Asset Management Software?

Financial Asset Management Software refers to a digital platform or system designed to manage an organization’s financial assets, whether they are investments, securities, accounts, or internal resources. It enables businesses to track, analyze, and optimize the performance and value of these assets in real-time.

From portfolio performance tracking and risk management to ensuring regulatory compliance, this software streamlines everything. In essence, it connects the dots between finance, strategy, and operations.

Difference Between Manual Asset Management vs. Automated Software

|

Manual Management |

Automated Software |

| Prone to human error |

Real-time accuracy |

| Time-intensive |

Time-saving automation |

|

Limited analytics |

Advanced data visualization and AI insights |

|

Difficult to audit |

Built-in audit trails and compliance tracking |

|

Disconnected workflows |

Integrated across departments and platforms |

Manual processes simply can’t match the agility, scalability, and intelligence that modern financial asset management solutions provide.

Why Businesses Need Financial Asset Management

The Cost of Inefficiency

In today’s financial landscape, outdated tools and disconnected systems are more than just inconvenient, they’re expensive. Many organizations still depend on spreadsheets and manual workflows to manage critical financial assets. While familiar, these methods introduce significant operational risks and inefficiencies that can quietly erode business performance over time.

Below are some of the common and costly consequences:

- Data Duplication and Loss

Manual entry increases the likelihood of redundant or conflicting data, leading to inaccuracies that can distort financial reports and decision-making. Moreover, without centralized storage, important records may be misplaced, overwritten, or lost entirely. - Compliance Violations

Financial regulations are becoming stricter across global markets. Managing assets manually makes it difficult to keep up with evolving compliance requirements, increasing the risk of costly penalties and reputational damage. - Inefficient Capital Allocation

Without a real-time view of asset performance, organizations may continue to invest in underperforming portfolios or delay reallocating funds to more profitable areas. This inefficiency reduces return on investment and strategic agility. - Poor Investor or Stakeholder Reporting

Producing detailed, accurate reports for investors, auditors, or internal stakeholders can take weeks when done manually. Delays and inaccuracies not only affect trust but can also lead to missed opportunities and misinformed decisions.

By adopting a modern financial asset management solution, businesses can eliminate these issues through automation, centralized data, and intelligent workflows.

Compliance, Transparency, and Efficiency

Financial institutions today operate in a highly regulated environment. From GDPR and SOX to MiFID II and IFRS, the list of compliance mandates continues to grow. Relying on spreadsheets and legacy systems makes it difficult to keep pace with these requirements.

Financial asset management systems are purpose-built to solve this challenge. They offer:

- Built-in regulatory rule checks

- Automated report generation for audits

- Role-based access and data encryption

- Transparent workflows with digital audit trails

With these tools in place, businesses not only avoid penalties but also gain confidence in their internal processes, paving the way for smoother audits and stronger investor relations.

Real-World Risks of Outdated Processes

The theoretical risks of manual asset management are backed by very real consequences in the market. Here are some notable examples that illustrate the importance of having a robust financial asset management system:

- Delayed Rebalancing Costing Millions

An investment firm operating with a fragmented, semi-manual asset tracking system failed to rebalance its portfolios on schedule. As a result, they missed critical market movements and lost an estimated $3.8 million in potential gains. A lack of automation and alerts made it impossible to act in real-time. - Regulatory Fine Due to Inaccurate Reporting

A large corporate enterprise using spreadsheet-based asset tracking failed to record depreciation data accurately across various departments. During a financial audit, this discrepancy resulted in a regulatory fine and a mandate to overhaul their internal asset reporting processes. - Security Breach in Insurance Firm

An insurance company maintained asset logs in unsecured, non-integrated files. When an employee’s laptop was compromised, sensitive asset data was leaked. This incident led to a reputational setback, client attrition, and a significant investment in data recovery and compliance upgrades.

These cases are not outliers, they are cautionary tales of what can happen when organizations delay the adoption of digital financial asset management solutions. The cost of doing nothing is often far higher than the cost of transformation.

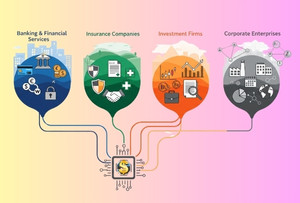

Financial Asset Management Software for Different Industries

Financial asset management software is not a one-size-fits-all solution. Different industries manage unique asset types, deal with industry-specific compliance requirements, and operate at varying scales of complexity. Customizing financial asset management systems to match these needs is essential to unlock their full potential.

Financial asset management software is not a one-size-fits-all solution. Different industries manage unique asset types, deal with industry-specific compliance requirements, and operate at varying scales of complexity. Customizing financial asset management systems to match these needs is essential to unlock their full potential.

Banks and financial institutions handle large volumes of diverse assets, from customer deposits and loan portfolios to investment vehicles and treasury holdings. With financial asset management software, banks can optimize the performance of their loan books, track cash reserves in real time, and ensure timely regulatory reporting. These platforms provide centralized oversight, enabling institutions to reduce risk exposure, improve liquidity management, and maintain full compliance with global financial regulations.

- Insurance Companies

Insurance firms are responsible for managing both their own financial assets and liabilities tied to policyholder claims. Asset-liability management becomes critical, especially when market conditions fluctuate. Financial asset management systems help insurers accurately track assets versus liabilities, monitor investment performance, and stay within risk tolerance thresholds. Moreover, they support adherence to regulatory frameworks such as Solvency II and IFRS, ensuring insurers maintain adequate capital buffers and accurate reporting.

- Investment Firms

Investment management companies rely heavily on timely market insights and precise control over diversified portfolios. Financial asset management software equips them with the tools to gain a comprehensive view of all asset classes—equities, fixed income, alternatives, and more. These systems automate portfolio rebalancing based on market movements, facilitate performance monitoring with real-time data, and help firms maintain compliance with investor mandates and trading policies. The result is improved decision-making, reduced manual workload, and better client outcomes.

- Corporate Enterprises

Large enterprises with multiple departments and global operations must manage a wide range of internal financial assets. These include fixed assets such as machinery, technology infrastructure, and real estate, as well as intangible assets like intellectual property and software licenses. Financial asset management software helps corporations track asset lifecycles, calculate depreciation, and plan capital expenditures efficiently. It also allows businesses to align asset management strategies with financial goals and ensure transparency in internal audits across geographies.

Core Features of Financial Asset Management Software

The true value of financial asset management software lies in the comprehensive features it offers to support strategic, compliant, and performance-driven asset oversight. These features are designed to eliminate inefficiencies, strengthen financial control, and enhance collaboration across finance, operations, and executive teams.

- Portfolio Tracking and Analysis

This feature enables businesses to monitor asset portfolios in real time, regardless of complexity or size. Users can track the performance of each asset class, assess risk exposure, and make timely adjustments based on market data. Whether it’s a multi-million-dollar investment portfolio or a corporate asset register, decision-makers gain immediate visibility into asset status and performance metrics.

- Advanced Reporting and Analytics

Modern asset management systems offer customizable dashboards and powerful analytics engines. Users can generate detailed reports tailored to the needs of different stakeholders, such as compliance officers, financial analysts, or senior executives. These reports provide actionable insights drawn from real-time data, making it easier to evaluate portfolio trends, identify inefficiencies, and plan for future asset allocations.

- Risk Management and Compliance Tools

Built-in risk assessment modules allow organizations to identify and address vulnerabilities in their asset strategies. From credit and market risk to operational and regulatory risks, the system continuously scans for anomalies and provides alerts when thresholds are breached. Automated audit trails and compliance workflows ensure adherence to financial regulations, reducing the risk of non-compliance and associated penalties.

- Integration with Accounting and ERP Systems

A critical feature of any robust asset management solution is its ability to integrate seamlessly with existing enterprise systems. This includes accounting platforms, enterprise resource planning (ERP) software, and business intelligence tools. With smooth data synchronization, financial teams can eliminate redundant data entry, ensure consistency across reports, and gain a holistic view of the organization’s financial health.

- Custom Dashboards for Stakeholders

Different roles within an organization require different views of financial data. Financial asset management software provides customizable dashboards tailored to the specific needs of each stakeholder. For example, C-level executives can access high-level summaries and key performance indicators, while analysts and finance teams can drill down into detailed asset-level data. This tailored visibility ensures that every user has access to the information they need, in the format that supports better decisions.

Understanding Financial Asset Management Systems

A financial asset management system is more than a standalone piece of software. It represents a strategic, enterprise-wide framework that unifies your organization’s financial data, analytical tools, workflows, and the people responsible for managing them. The system becomes a central nervous system for financial visibility and control, ensuring that every department works from a single source of truth.

A financial asset management system is more than a standalone piece of software. It represents a strategic, enterprise-wide framework that unifies your organization’s financial data, analytical tools, workflows, and the people responsible for managing them. The system becomes a central nervous system for financial visibility and control, ensuring that every department works from a single source of truth.

Where traditional asset management tools operate in silos or support only limited functionalities, a full-scale financial asset management system provides an integrated, end-to-end solution. It connects departments, streamlines operations, and ensures that both strategic decisions and routine transactions are supported by accurate, real-time information.

Scalability and Security

As your organization grows, whether in terms of volume of assets, geographical spread, or number of users, your asset management needs evolve. A robust financial asset management system is designed to scale effortlessly, handling increasing complexity without compromising performance.

Security is equally critical. Financial data is highly sensitive and often subject to regulatory scrutiny. To protect this information, modern systems incorporate multi-factor authentication to verify users, role-based access controls to limit data exposure based on responsibility, and end-to-end encryption to safeguard information both at rest and in transit. With these measures in place, organizations can operate with confidence, knowing their data is secure and compliant.

Types of Financial Asset Management Systems

Choosing the right deployment model is essential to align your system with operational requirements, budget constraints, and regulatory considerations. Custom financial asset management software can be tailored to fit these needs more precisely. Below are the three most common types of financial asset management systems, each with its own benefits.

Cloud-Based Systems

Cloud-based financial asset management systems are hosted on secure external servers and accessed via the internet. This model offers several advantages, including rapid deployment, flexible access from any location, and reduced IT maintenance costs. These systems are particularly well-suited to businesses seeking agility and scalability without the burden of managing on-site infrastructure. Updates and upgrades are handled by the service provider, ensuring that organizations always operate with the latest features and security protocols.

On-Premise Systems

On-premise systems are installed and operated within an organization’s own data centers. This option gives businesses complete control over their infrastructure, customization, and data governance policies. It is often preferred by institutions in highly regulated industries such as banking, government, or healthcare, where stringent data residency and compliance requirements exist. While initial setup costs may be higher, the ability to tailor every aspect of the system to internal protocols can provide long-term strategic advantages.

Hybrid Systems

A hybrid model combines the best elements of both cloud and on-premise systems. Organizations can store sensitive data on local servers while leveraging the cloud for scalability, remote access, or specific applications. This approach offers a high degree of flexibility and is ideal for businesses in transition, those that want the control of on-premise solutions with the innovation and convenience of cloud-based services. A hybrid deployment supports phased digital transformation while minimizing disruption to ongoing operations.

Key Stakeholders Who Benefit

Solutions for Individual Investors

- Robo-Advisors: AI-driven portfolio management with minimal manual effort.

- Personal Finance Apps: Track net worth, investments, and returns.

- Brokerage Platforms: Trade and manage portfolios from a single interface.

Solutions for Financial Advisors/Wealth Managers

- All-in-One Platforms: Combine CRM, portfolio management, and financial planning.

- Specialized Tools: Tailored for alternative investments, ESG tracking, or tax optimization.

Solutions for Institutional Investors/Corporations

- Enterprise-Level Systems: Handle complex portfolios across countries.

- ERP Integration: Automate capital asset tracking and reporting.

- Custom Workflows: Assign roles, approvals, and compliance checkpoints.

Benefits of Implementing Financial Asset Management Solutions

- Data-Driven Decisions

Use real-time insights to optimize performance and minimize risk. - Operational Efficiency

Automate tasks, reduce overheads, and eliminate redundancies. - Stronger Risk Mitigation

Early warnings and predictive analytics to prevent losses. - Stakeholder Confidence

Transparent reporting builds trust with clients, auditors, and regulators.

At Experion, we’ve helped enterprises replace cumbersome legacy systems with AI-powered financial asset management software tailored to their industry, delivering both speed and strategic clarity.

How to Successfully Implement a Financial Asset Management System

Implementing a financial asset management system is a strategic initiative that impacts people, processes, and technology across the organization. Success depends not just on choosing the right software, but also on how well it is planned, integrated, adopted, and measured.

Implementing a financial asset management system is a strategic initiative that impacts people, processes, and technology across the organization. Success depends not just on choosing the right software, but also on how well it is planned, integrated, adopted, and measured.

Step-by-Step Guide

- Assessment – Define Business Goals and Identify Current Gaps

Before exploring software options, organizations must assess their current state. This includes mapping out existing asset management processes, identifying inefficiencies, and defining clear business goals. Whether the priority is regulatory compliance, improving reporting speed, or reducing operational costs, having a well-articulated vision lays the foundation for a successful implementation.

- Planning – Select the Right System Type and Define Scope

Based on the assessment, the next step is to choose the right type of system—cloud-based, on-premise, or hybrid. Planning should also include defining the system scope, timelines, resource allocation, and budget. Key stakeholders from IT, finance, compliance, and operations should be involved at this stage to ensure alignment with enterprise-wide objectives.

- Integration – Ensure Seamless Connection with Existing Systems

For a financial asset management system to deliver true value, it must integrate smoothly with other enterprise systems such as ERP (Enterprise Resource Planning), CRM (Customer Relationship Management), and BI (Business Intelligence) platforms. This allows for real-time data synchronization, reduces manual data entry, and ensures that reporting and analytics are consistent across departments.

- Training – Upskill Users and Assign Role-Based Access

Without proper training, even the most sophisticated systems will underperform. A structured training plan should be rolled out across teams, covering everything from basic system navigation to advanced reporting features. Role-based access should be configured to ensure that users only see the data relevant to their responsibilities, which improves both efficiency and data security.

- Monitoring – Set KPIs and Review Usage Metrics

Once the system goes live, continuous monitoring is essential. Key performance indicators (KPIs) should be defined to track system usage, data accuracy, process improvements, and user engagement. Regular reviews help identify bottlenecks, training gaps, or opportunities for further optimization.

Change Management

Technology adoption is as much a cultural shift as it is a technical upgrade. Resistance to change is common, particularly if employees feel left out of the process or unclear about the benefits.

To manage this effectively:

- Communicate the “Why” Clearly

Explain the strategic reasons behind the change, whether it’s enhancing efficiency, reducing risks, or staying compliant. When people understand the purpose, they are more likely to support the transition. - Involve End-Users Early

Including future users in the planning and testing phases gives them a sense of ownership and helps the team identify practical requirements or usability issues before full-scale rollout. - Offer Hands-On Support

Go beyond training sessions. Provide live demos, access to sandbox environments, and ongoing technical support. Equip change champions within teams to offer peer guidance and encourage adoption from within.

Successful change management ensures that the new system is not only installed, but fully embraced across all levels of the organization.

Measuring ROI

To justify the investment and guide continuous improvement, organizations should track tangible and intangible returns after implementation. These metrics can be measured over time and benchmarked against pre-implementation baselines.

Key indicators to monitor include:

- Reduction in Reporting Time

Measure how long it now takes to generate investor reports, audit documentation, or performance summaries compared to previous workflows. A significant decrease signals efficiency gains. - Accuracy Improvements

Fewer data discrepancies or manual errors in asset tracking, reconciliation, and reporting are a clear indicator that the system is improving data quality and reducing human error. - Compliance Breaches Prevented

Track the number of audit issues, late filings, or policy violations before and after implementation. A drop in incidents suggests the system is effectively enforcing compliance protocols. - Cost Savings in Manual Processes

Calculate savings from reduced labor hours, paper-based documentation, and redundant software licenses. Consider the opportunity cost of reallocating skilled resources from manual tasks to strategic initiatives.

Beyond financial ROI, qualitative benefits such as improved stakeholder confidence, better decision-making, and higher employee satisfaction also contribute to long-term value.

Future Trends in Financial Asset Management

- AI and Predictive Analytics

From portfolio forecasting to risk alerting. - Blockchain

Enables secure, immutable transaction tracking and asset provenance. - Cloud-native & Mobile-first

Asset visibility anytime, anywhere. - Automation in Auditing

Auto-flag anomalies, generate audit reports on demand.

Choosing the Right Financial Asset Management Software

Key Evaluation Criteria

- Scalability: Can it handle your asset growth over 5–10 years?

- Security: Is it compliant with GDPR, ISO, SOC2?

- Integration: Will it work with your ERP, BI tools, etc.?

- Ease of Use: Is the UI intuitive for all roles?

How Experion Can Offer Support?

With over 19 years of expertise in custom enterprise software development, Experion Technologies brings deep industry knowledge and advanced technology capabilities to the financial services sector. We specialize in building secure, scalable, and intelligent financial asset management solutions tailored to meet the specific needs of investment firms, financial advisors, insurance companies, and corporate finance teams.

With over 19 years of expertise in custom enterprise software development, Experion Technologies brings deep industry knowledge and advanced technology capabilities to the financial services sector. We specialize in building secure, scalable, and intelligent financial asset management solutions tailored to meet the specific needs of investment firms, financial advisors, insurance companies, and corporate finance teams.

Our focus is on delivering end-to-end digital transformation, from discovery and system design to deployment, integration, and ongoing support. Whether you are looking to automate asset tracking, improve data-driven decision-making, or ensure compliance with evolving regulations, Experion can be your strategic technology partner.

Case Study: Data Analytics-Powered Investment Platform

The Client

A leading financial consulting firm based in the United States partnered with Experion to digitize and modernize its portfolio management services. The client manages approximately $30 billion in financial assets and supports a vast network of over 1,000 financial advisors offering services such as investment management, tax consultations, and training for aspiring financial advisors.

The Challenge

Despite its impressive scale, the client relied heavily on manual processes and Excel spreadsheets to manage sensitive financial data and execute core operations. Their legacy workflows led to significant limitations, including:

- Inefficient data handling and reporting cycles

- Lack of real-time insights for advisors and clients

- Absence of an integrated portfolio management system

- Insecure storage and decentralized access to customer data

- Limited capacity to scale their services or onboard new advisors efficiently

Given the rapid digital evolution of the FinTech space and rising customer expectations, the firm needed a platform that could support smarter decision-making and handle increasing volumes of structured and unstructured data.

Our Solution

Experion developed a comprehensive, data analytics-powered financial portfolio management system designed to automate, integrate, and optimize the client’s core financial operations. The solution was architected to ingest real-time market data, deliver advanced analytics, and improve service delivery across the advisor network.

Key features of the platform included:

- Real-time data analytics capabilities leveraging both stock market and mutual fund data to enable timely investment decisions

- Advanced data extraction engine to fetch and update critical market information such as stock tickers and mutual fund prices using third-party APIs

- Tableau-powered dashboard that enabled financial advisors to generate real-time insights, create customized investment reports, and benchmark portfolios against historical trends

- User-friendly web interface accessible across popular platforms, offering seamless navigation for both advisors and clients

- Secure data aggregation and storage, consolidating stock-related data records and customer profiles into a centralized, compliant environment

The system not only streamlined internal processes but also positioned the client as a future-ready, tech-driven advisory firm.

Business Impact

The newly developed investment platform delivered significant business and operational outcomes:

- The system enabled the onboarding of over 1,000 financial advisors, vastly improving advisor engagement and service consistency

- The platform successfully handled the import of over 100,000 stock-related data records daily, allowing advisors to make informed decisions backed by live data

- The firm witnessed a 10-fold growth in its advisor network, scaling operations without compromising performance or security

- By consolidating data from multiple sources and enabling real-time portfolio monitoring, the platform empowered executives with greater visibility and control

- The transformation elevated the overall client experience, driving long-term loyalty and market competitiveness

Experion’s role went far beyond software delivery. By understanding the client’s core challenges and leveraging our expertise in data analytics, financial technology, and secure systems design, we helped build a powerful foundation for sustainable growth.

If your financial institution is ready to evolve from spreadsheets to smart systems, we’re here to help you design, develop, and deploy a solution tailored to your needs.

Conclusion

In today’s high-stakes financial world, relying on fragmented tools and spreadsheets is no longer viable. Financial asset management systems are no longer a luxury, they’re a necessity.

Investing in the right technology today secures your organization’s agility, profitability, and compliance tomorrow.

Key Takeaways

- Financial asset management software empowers smarter, faster, more compliant decisions.

- Manual systems introduce risk, inefficiency, and hidden costs.

- Every industry, from banking to corporate enterprises, can benefit.

- Experion delivers tailor-made financial asset management solutions that scale with your business.

With Experion as your tech partner, you’re not just implementing software. You’re building a future-proof financial ecosystem designed to evolve with your goals.