Introduction

Experion’s expertise in data modernization empowers banking institutions to seamlessly integrate and optimize their data infrastructure, enabling real-time analytics and enhanced decision-making. In an era where data drives decision-making and customer experiences, the Banking, Financial Services, and Insurance (BFSI) sector is increasingly recognizing the need for data modernization. Despite the clear benefits, many financial institutions struggle with legacy systems and data quality issues. This blog explores the challenges and the critical steps needed for successful data modernization.

The Need for Data Modernization

The past two decades have transformed banking operations significantly. The shift towards virtual banking and digital payments accelerated due to the financial crisis of 2008 and the recent pandemic. Today, data plays a crucial role in defining enterprise goals and achieving business growth. The key to success lies in leveraging available data and strategically architecting it to attract new customers, maintain existing ones, and enhance customer satisfaction. Transitioning from legacy infrastructures to a modern data architecture that supports data-driven operations and analytics with high security and governance is imperative.

Challenges in Data Modernization

Customer Experience and Expectations

Modern customers expect seamless, personalized experiences, particularly in mobile and online banking. However, many institutions struggle to prioritize the customer experience. Outdated systems are often incapable of delivering the personalized and efficient services that customers now demand. This gap can lead to dissatisfaction and churn.

Lack of Customer Intelligence

The absence of a “Single View of Customer” hampers effective customer segmentation and engagement. Without a unified view, banks cannot fully understand their customers’ needs and behaviors. Implementing a comprehensive customer intelligence system can significantly improve customer interactions and loyalty by providing actionable insights into customer preferences and trends.

Ineffective Digital Transformation

Digital transformation efforts fall short without a robust data platform. Banks need to harness the power of their data to innovate and stay competitive. However, many are held back by fragmented data systems that limit their ability to make data-driven decisions and offer advanced services.

Data Abundance

Managing the volume, velocity, variety, and veracity of data is a significant challenge. Ensuring data accuracy, comprehensiveness, and coherence is crucial for meaningful insights. With the exponential growth of data, traditional systems often struggle to keep up, leading to data silos and quality issues.

Competition from FinTech

Neo-banks and FinTech companies are setting high standards in customer service and efficiency. These agile competitors leverage modern technologies to offer superior services and products. Traditional banks must modernize rapidly to stay competitive and meet evolving customer expectations.

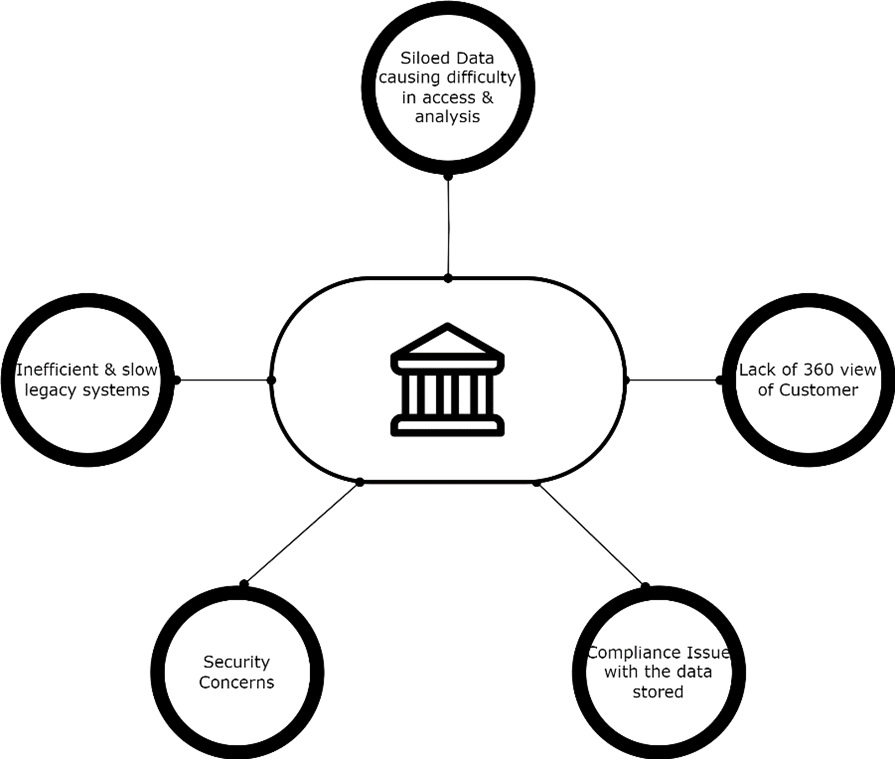

Here is a simplified view of the core challenges that the banking institute might face if they are still operating with a legacy data platform. Addressing them through a modern data platform should always be the key objective.

The First Step Towards Data Modernization

Experion’s expertise guides organizations in selecting the optimal solution that balances cost, scalability, and performance to meet their unique business needs. The initial decision is whether to build the modern data platform on-premises or in the cloud. Both approaches have their merits and challenges.

On-Premises

Many businesses continue to use traditional methods with in-house infrastructure. On-premises solutions offer control over data and systems, which can be critical for regulatory compliance and security. However, they come with significant challenges, such as high upfront costs, limited scalability, and the need for ongoing maintenance and upgrades.

Cloud Platforms

Cloud platforms offer scalability, flexibility, and the ability to handle multiple inconsistencies at once. They enable rapid deployment, reduce infrastructure costs, and provide access to advanced analytics and AI tools. Cloud solutions can also enhance collaboration and data sharing across the organization. However, they require careful management of data security and regulatory compliance.

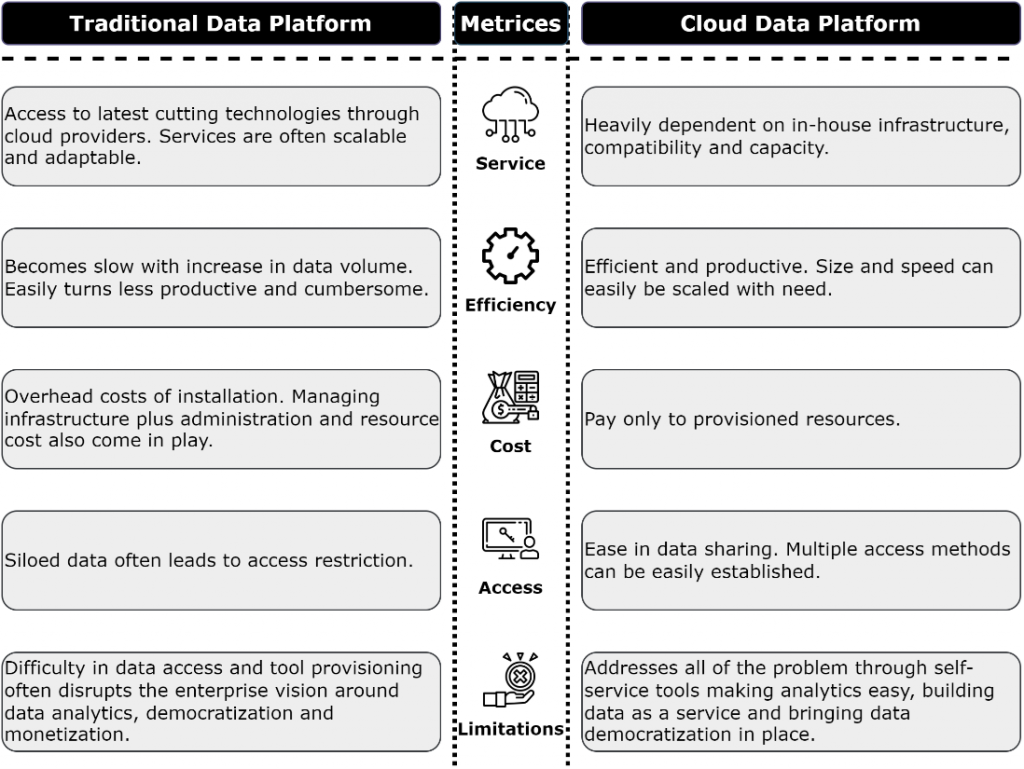

Many businesses continue to use traditional methods (with in-house infrastructure), albeit with some complications and challenges. Perhaps the effectiveness diminishes over time as the business landscape undergoes changes due to technological disruption. The modern approach (the cloud data platform) has a distinct pace and benefits that can handle multiple inconsistencies at once. This diagram highlights the key differences between traditional and modern data platforms:

Conclusion

Overcoming these challenges with a strategic approach to data modernization can enable banks and financial institutions to enhance customer satisfaction, improve operational efficiency, and stay competitive. The journey towards data modernization begins with the right decisions about infrastructure and a commitment to leveraging modern technologies. By embracing cloud solutions and advanced data analytics, financial institutions can unlock new opportunities for growth and innovation.

Modernizing data platforms is not just a technological upgrade but a strategic transformation that positions BFSI institutions for future success. It requires a clear vision, strong leadership, and a willingness to invest in new technologies and processes. Ultimately, the benefits of enhanced customer experiences, operational efficiencies, and competitive advantages make data modernization a crucial priority for the BFSI sector.

With Experion’s tailored data modernization services, banks can drive transformative growth, enhancing their competitive edge and delivering superior customer experiences through streamlined, data-driven processes.